Hurricane Ian, the Category 4 storm that recently wreaked havoc with its wind, rain, and the resulting flooding across parts of Florida and South Carolina, got me thinking about California’s flood zones and their potential effect on owning a home in the Golden State. Because of current drought conditions, you may not realize that we do have floods in California. You may think that California has only fires, and with increasing frequency and more devastation than ever before. And of course, you know that we have earthquakes. We even have mudslides, if it ever dares to rain in our parched state. And we do not have hurricanes or tropical storms here. (Yet.)

But storms are not the only problem. Predictions of rising sea levels in California and other coastal states have been around for years, and levee breaks happen all the time. We cannot afford to ignore them. Science is not on our side. Climate change is here to stay, and it has already affected our coastline. The long-term changes in weather patterns that are in store for our state remain to be seen. But the sea level has already been rising.

According to the California Natural Resources Agency’s (“CNRA”) reports to the Governor on California’s Climate Adaptation Strategy (in 2009 and 2013), approximately 85% of California’s population lives and works in coastal counties. The sea level along California’s coasts has risen nearly nine inches in the past century and is projected to rise by as much as 20 to 55 inches by the end of this century. A 55-inch sea level rise could put nearly half a million people at risk of flooding by 2100, and threaten $100 billion in property and infrastructure, including roadways, buildings, hazardous waste sites, power plants, and parks and tourist destinations. Coastal erosion could have a significant impact on California’s ocean-dependent economy, which is estimated to be more than $46 billion per year. (“Climate Change Impacts in California | State of California – Department …”) (www.oag.ca.gov)

The CNRA also points out that the Sierra Nevada snowpack functions as the most important natural reservoir of water in California. The snowpack is created in fall and winter and slowly releases about 15 million acre-feet of water in the spring and summer, when California needs it most. California’s dams and water storage facilities are built to handle the snow melt as it happened in the past. But higher temperatures are now causing the snowpack to melt earlier and all at once. (“Climate Change Impacts in California | State of California – Department …” www.oag.gov) Earlier and larger releases of water could overwhelm California’s water storage facilities, creating risk of floods.

It appears that our state and national governments are finally paying attention to the issue. On the state level, Governor Gavin Newsom signed into law five climate and energy bills in September 2022. At a cost of $54 billion, the new laws take on everything from reducing greenhouse gas emissions, to promoting clean energy. It was not easy to get the legislation through the State Senate and Assembly, but Newsom pushed hard. (After all, he is on the ballot this year.)

And on the national level, President Biden signed into law the first real sweeping legislation on climate change that will invest $370 billion in spending and tax credits in low-emission forms of energy to fight climate change. The objective is to help the U.S. cut greenhouse gas emissions by an estimated 40% below 2005 levels by 2030. This would put us within striking distance of his ultimate goal of cutting emissions at least 50% over that time period.

(Biden Signs Climate, Health Bill into Law as Other Economic Goals Remain, Jim Tankersely, The New York Times, Aug. 16, 2022)

Whether these actions will be enough to stem the tide (so-to-speak) of climate change and rising waters, we do not know. Is it too late? And whether and how the new laws will affect California is also not yet clear. In the meantime, the prices of homes in our state, although leveling off a bit from earlier this year, due perhaps in part to the increase in interest rates and the fall of the stock market, have risen exponentially over the last few years. According to the California Association of Realtors in September 2022, home values have gone up 18.5% since June 2021. And Zillow reports that since the last decade (Aug 2012), California home values have appreciated by nearly 157.8% — Zillow Home Value Index.

These numbers tend to show that if climate change and the possibility of fires, earthquakes, mudslides and flooding are going to dissuade people from buying homes in California, that would already be reflected in the cost of home ownership here. Californians do love their state. We seem to be in denial. But what will happen when the water keeps coming? How do homeowners protect themselves and the value of their properties?

There are known flood zones in our coastal state and, like the risk of fire in forested areas and the risk of earthquakes near fault lines, that cannot and should not be ignored. So, what does one do if they own a home in a “flood zone.” And where are these flood zones?

The California Department of Water Resources (CDWR) reports that millions of Californians are at risk from flooding along thousands of miles of streams, rivers, lakes and coastline. Floods can bring devastating impacts to regions, and no one can predict when and where floods will occur. But hydrologic engineers and other experts can estimate the likelihood of annual flood flows and stages that could occur in any location with collected data. And flood information can be used to estimate average annual damage. (www.water.ca.gov/Flood-Management)

The CDWR administers a Flood Risk Notification Program that provides flood risk awareness to property owners, local, state and federal agencies, and the public at large. Its goal is to “encourage people to understand levee systems, stay aware of flood risks, take appropriate actions to protect themselves, their property and their personal possessions, and to facilitate flood recovery.” (www.water.ca.gov/Flood-Management)

To that end, it “sends out annual notices to at-risk property owners, maintains accurate [flood] . . . maps, provides people with useful ways to assess risk and reduce flood loss, establishes outreach and educational projects with public involvement, and collaborates with federal agencies, local agencies and communities.” (www.water.ca.gov/Flood-Management)

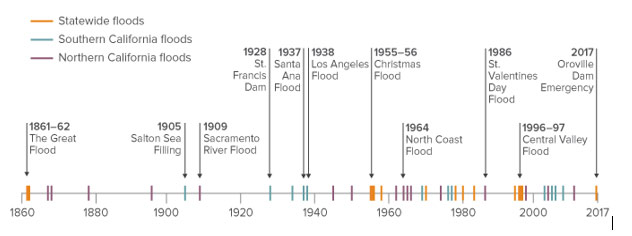

Damaging floods are common in California – more common than you think.

SOURCE: Updated from California Department of Water Resources, California’s Flood Future, Attachment C (2013).

This figure includes floods that caused significant property damage and/or loss of life. The Oroville Dam emergency is included here because it highlights increasing risk from aging flood infrastructure and is likely to impact flood policy.

Also note how the frequency has changed in the last seventy years with increased coastal flooding in addition to valley floods.

So, what does this all mean for home ownership in California?

We live in what some describe as the most beautiful state in the country. We have a more temperate climate than most other states, and we enjoy magnificent landscapes from mountains to deserts to the Pacific with its rocky cliffs and pristine beaches. This is why we live here.

So, how do we protect ourselves from what scientists see as the inevitable? Do we avoid buying homes in the Golden State? Move to the least likely areas to flood? The flood risk in California is very real. Of course, there are certainly areas that are more prone to flooding than others. To determine whether your home is in a high-risk flood zone, check the Federal Emergency Management Agency’s (FEMA) flood maps at https://www.fema.gov/flood-maps. The maps change from year to year.

Surprisingly, California does not require flood insurance, but most mortgage lenders do if your home is in a “special flood hazard area” as determined by FEMA. Even if insurance is not required however, unless your home is far away from the coast or from any damns or levies that could potentially break, or unless your home is on higher elevation than surrounding areas, you should consider purchasing flood insurance. Typical homeowners’ policies do not cover damage to your home from floods (or earthquakes, for that matter). In fact, most insurers specifically exclude coverage for damage from floods. And should damage to your home caused by flood occur, unless your area is declared a federal disaster, there will be no federal assistance available to help with your cleanup and rebuilding costs. Flood insurance can help you manage the risk of being in a flood-prone area.

The National Flood Insurance Program (NFIP) makes federal flood insurance available to vulnerable homes and businesses, and studies show that those with insurance recover more quickly from flood emergencies. The federal requirement that homes within the so-called 100-year floodplain (which is especially prone to floods) carry insurance is also a disincentive to development in high-risk areas. But the NFIP is deeply in debt and its future is uncertain. California may need to develop new strategies—including restrictions on development in floodplains and a state-run insurance program—to reduce economic risk. (The Public Policy Institute of California (PPIC) )

To date, no state-run flood insurance is available. But there are private insurers that sell flood insurance in California, and they tend to charge lower premiums than the NFIP. Shop around.

Most of California is at risk of flooding; just about every county has been declared a flood disaster area at least once. Although we have long periods of drought to be sure, in recent decades, heavy rain in northern and central California has caused rivers to flood and damage the surrounding area. While flood insurance will not cover all issues and every policy has deductibles and limits, you may easily have to pay hundreds of thousands of dollars in expenses yourself if you have no coverage in place.

Owning a home in one of the most beautiful places to live in the country is wondrous, but it does come with risks. And while the state and federal governments work to reduce emissions and promote clean energy to end the prevailing trend of dangerous effects from climate change, we all need to do what we can to minimize the potential loss. That includes buying flood insurance to protect our properties.