There is no doubt your main concern after receiving your California real estate license and becoming a new real estate agent will be getting clients and securing listings. But you must also be well-prepared for the end of the journey with each client, otherwise known as close of escrow, or more simply, the closing. It helps to have a good grasp of the process before you get there so that both you and your clients know what to expect. It is your job to prep them, so better get prepped yourself! The fewer the surprises, the less stress there will be, and the more smoothly the closing will go.

Part of your job as an agent will be to form relationships with other professionals, such as home inspectors, lenders, and title companies. Your client will look to you for recommendations. Rather than recommending just one, it is better to give your client a list and he or she can choose from among those listed. Knowledgeable, experienced professionals will help make the road less bumpy.

What activities must be completed before the closing?

• Securing the Financing

If your client is a buyer, it is likely that he or she will need to take out a mortgage to be able to purchase a home. The lender your client chooses will ask for a great deal of information about both the home the borrower intends to buy, as well as his or her income and the sources of that income. It can be daunting, but a professional lender will keep things going without a hitch. Note that a lender will require a home appraisal and a pest report. Lenders typically do not require a home inspection, but your client should get one anyway, as discussed below. Once all of this has been accomplished, you and your client will be one step closer to signing the closing documents and getting the keys to their new home!

• Scheduling and Completing Inspections

As discussed above, the lender requires a pest inspection and report. It is especially important to know if there is any termite damage to the house that requires repair. And a buyer should get a general home inspection as well. Why? A home inspection will identify any major issues with the home. In fact, most buyers make the inspection a contingency in the contract with the seller. If there are significant defects, the buyer has a certain period of time to back out of the deal.

A good inspector will thoroughly inspect both the interior and exterior of the home. On the exterior, he or she will look at the roof, the exterior walls, the foundation (if visible), the grading, and the garage. If the foundation is not visible, any cracking in exterior walls or the garage could be a sign that there is a foundation problem. An interior inspection will reveal any issues with plumbing, electrical, heating, ventilation, air conditioning, kitchen appliances, bathrooms, and any evidence of leaking, which may cause mold or mildew. The inspector will also look at fire safety and make sure the smoke detectors are functioning properly.

• Hiring a Title Company

Hiring a title company is critical for a home sale/purchase for many reasons. But the most important reason is that the title company will research the title to the home to make sure it is clear, i.e., that no one can come forward later and claim to have an interest in the property. And if there are monetary claims against the property, such as liens, outstanding taxes, or claims against the owner, they can all be paid off before the home changes hands. The title company provides the buyer with title insurance to protect the buyer’s right to ownership of the home without any encumbrances.

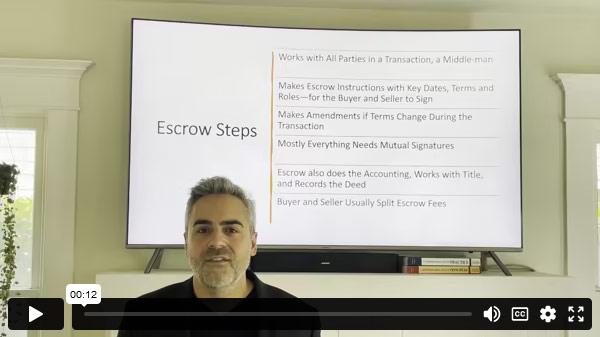

Title companies also provide escrow services. They handle all the money in the transaction, first making sure the seller pays off his or her mortgage to the seller’s lender as well as collecting the deposit from the buyer. Money that is to change hands between the buyer and the seller is held by the title company “in escrow,” until the closing. And, speaking of the closing, the title company also prepares all the title/transfer documents (see below) relating to the finances and prepares any deeds or documents regarding clear title, making sure they are properly executed and recorded.

• Reviewing Documents

Who will be at the closing?

Typically, the buyer attends the closing with his or her real estate agent. Also in attendance is the escrow officer or escrow agent from the title company who manages everything, including the documents, who signs what, and what money goes where. Sometimes the seller attends with his or her agent as well.

What will happen at the closing?

While it is not exactly a totally stress-free process, with all the people in place doing what they are supposed to be doing in the time and manner they are supposed to be doing it, the process should have few surprises and go relatively smoothly and pain free. Just be sure to prepare in advance and keep your client informed about the necessary steps so they can be ready to go as well.